Financial Reporting: Making It More Effective for Investors

An excellent article on the short-comings of accounting and how it can be changed to be more effective.

An excellent article on the short-comings of accounting and how it can be changed to be more effective.

An interesting collection of analyst mistakes. Unfortunately, we will be repeating the first.

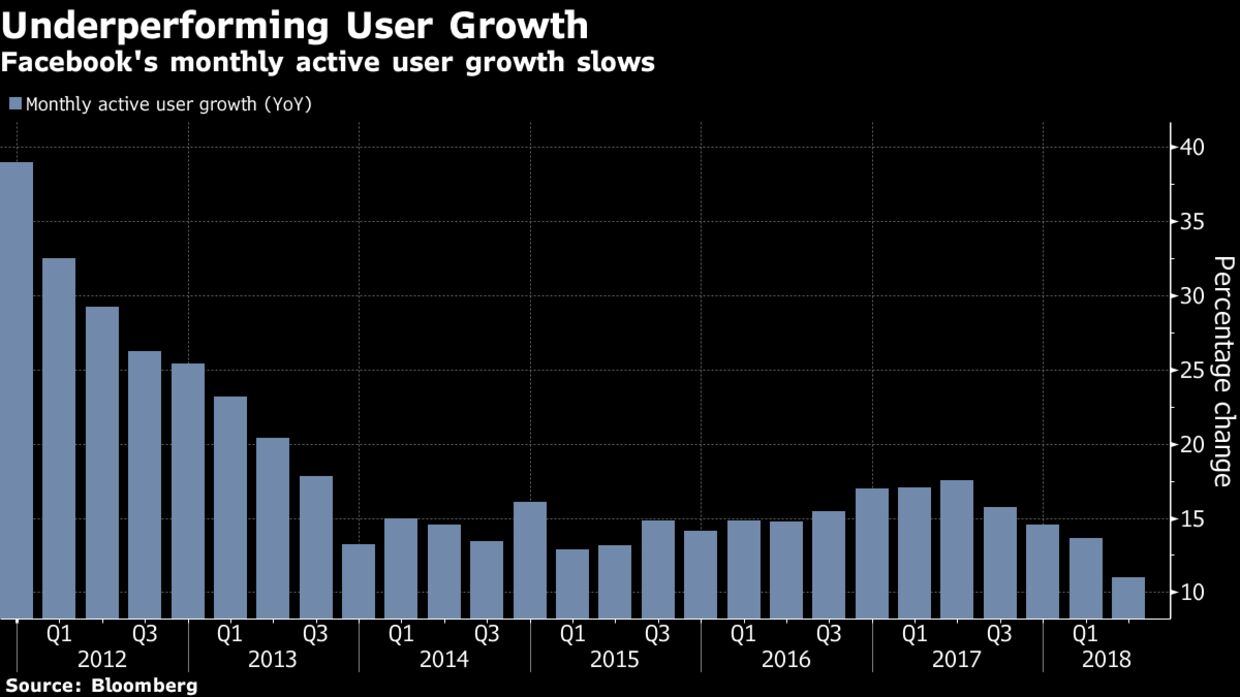

Facebook’s subscriber growth has continued to slow. This quarter’s reported growth was particularly slow although still respectable. The chart in this article (courtesy of Bloomberg) illustrates Facebook’s rapid approach to maturity and illustrates the limits to exponential growth rates.

As part of my FINA 470 lecture on Goodwill, Intangibles and Research and Development, I include a brief discussion of The End of Accounting and why the authors believe that US GAAP no longer produces reports that are meaningful for capital market decision making. O’Shaughnessy Asset Management has released a new research report discussing Negative Equity and Veiled Value. It makes a parallel argument to the book.

A contributing factor to the negative equity and erosion of corporate book value is the high level of equity buybacks. Research indicates that the increasing buybacks are not contributing to increases in stock prices. Academic research contends that the principal beneficiaries are management and not shareholders.

Yes, in addition to Spam, Hormel is one of the leading peanut butter companies together with another FINA470 favorite: Smuckers.